Complementary currencies Įngland has had the Totnes pound since it was launched by Transition Towns Totnes Economics and Livelihoods Group in March 2007 A Totnes Pound is equal to one pound sterling and is backed by sterling held in a bank account. In fact, technically, no banknote (including Bank of England notes) qualifies as legal tender in Scotland or Northern Ireland. They are exchangeable with other pound notes on a one-to-one basis, and circulate freely within the United Kingdom, though not legal tender, not even in Scotland and Northern Ireland. They are subject to central bank (the Bank of England) regulations concerning "ring-fenced backing assets" and are backed in part by deposits at the Bank of England. In Scotland, the Bank of Scotland, Clydesdale Bank, and the Royal Bank of Scotland, and in Northern Ireland, the Bank of Ireland, Danske Bank, First Trust Bank, and Ulster Bank, are authorised by Parliament to issue Pound sterling bank notes. Most automated teller machines dispense private Hong Kong bank notes. In Hong Kong, although the government issues currency, bank-issued private currency is the dominant medium of exchange. In 1976, Wickrema Weerasooria published an article which suggested that the issuing of bank cheques violated this section, to which banks responded that since bank cheques were printed with the words "not negotiable" on them, the cheques were not intended for circulation, and thus did not violate the statute.

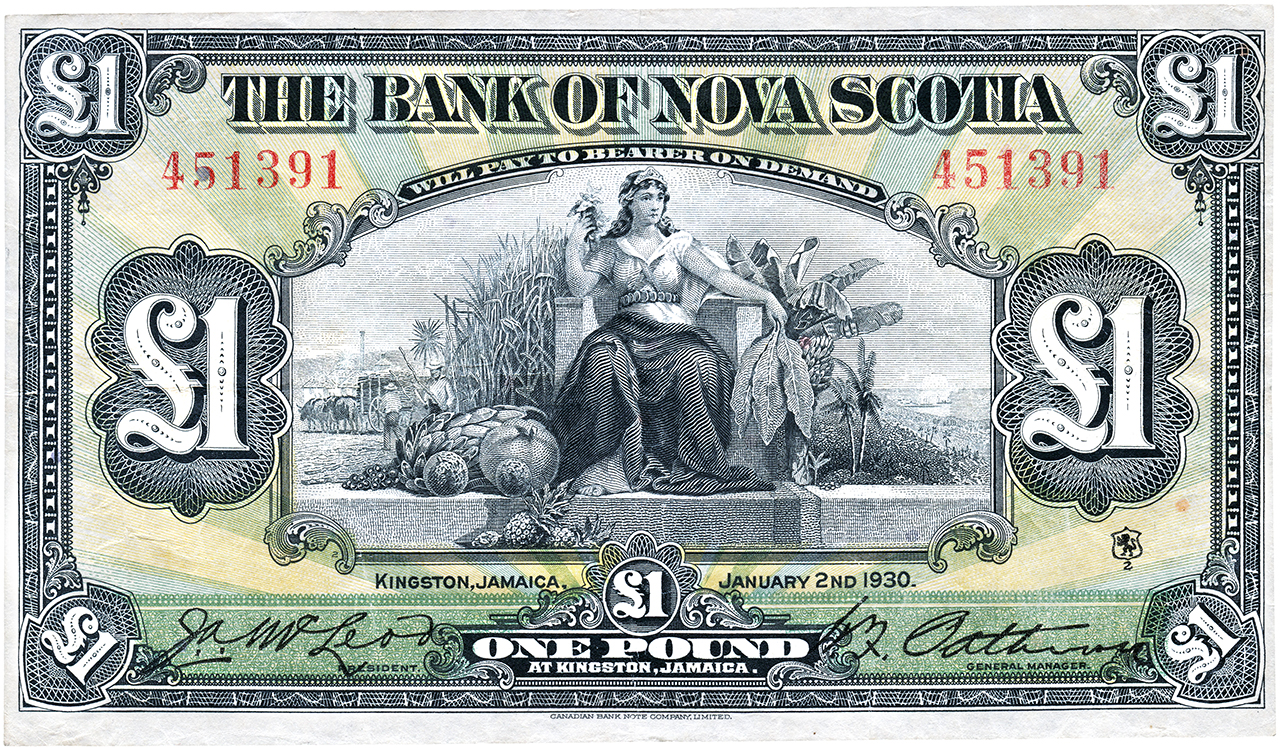

44(1) of the Australian Reserve Bank Act 1959 prohibited the practice outright. This Act was subsequently repealed by the Commonwealth Bank Act 1945, which imposed a £1000 per day fine for private currencies, and s. In Australia, private currency had first been used since the arrival of European settlers in 1788, and into the early years of Federation before the Bank Notes Tax Act 1910 effectively shut down the circulation of private currencies by imposing a 10% tax on the practice, making it economically prohibitive. Private currency issued in Australia by The City Bank of Sydney circa 1900 These include commercial trade exchanges that use barter credits as units of exchange, private gold and silver exchanges, local paper money, computerized systems of credits and debits, and digital currencies in circulation, such as digital gold currency. Today, there are over four thousand privately issued currencies in more than 35 countries. Cryptocurrency is illegal as a currency in a few countries (mainly in West Asia and North Africa). Digital cryptocurrency is sometimes treated as an asset instead of a currency. In many countries, the issuance of private paper currencies and/or the minting of metal coins intended to be used as currency may even be a criminal act such as in the United States (18 U.S. It is often contrasted with fiat currency issued by governments or central banks.

A private currency is a currency issued by a private entity, be it an individual, a commercial business, a nonprofit or decentralized common enterprise.

0 kommentar(er)

0 kommentar(er)